Are you looking for an instant credit card? Then we must say the online application is the best way to apply because it only takes less than 60 seconds. However, you may think this is very unusual to apply, but do not get panic because your application will instantly be approved.

This is the best way to start your spending within a week. Now you might have a question, how can it work? Then let us share with you that an instant approval credit card allows you to get quick feedback within minutes. You need to apply online and it takes around 10 minutes to complete.

Instant Approval Credit Cards Working Process-

Are you thinking about online approval? There are most of the banks consider you to register for online cards. The credit card supplier instantly checks your credit status from the online national credit bureau and responds to you quickly. However, if it takes more than 60 seconds, only it is possible when your application might have any issue.

Do you know what you can get? If you apply online application for credit cards, you can get some extra security profit. Here you can get the protection of 128-bit encryption and it is much easier to track. Not only that! It lessens the scope of document losses.

More than anything, you need to remember one thing that your online application completely depends upon your credit status and history. Moreover, it also depends upon your income, savings balance in the bank, and the information that you provide in your application. In this context, we may assure you that, if you carry an excellent rate of credit score then it just takes a few minutes to approve.

Four steps to apply for instant approval credit cards

Throughout the whole process, we can serve you an easy four-step solution to ensure your application properly-

Step 1. Compare the options:

Before applying online you should compare the alternative options and after assuring yourself you need to make sure the following requirements to get an online credit card within 60 seconds-

- Fees

We will remind you that your foreign transaction, annual payment, balance transfer, and late payment; everything will be taken into consideration.

- Rates

Before setting your card application, you should check your APR for purchases, balance transfers and cash advances.

- Features

Whenever you go for alternative comparison you should remember a few benefits like- signup bonuses, rewards, balance transfer offers, purchase protection, and mandatory insurance. Moreover, we will tell you to maintain a certain credit balance to afford the credit card and get extra features.

Step 2. Check the Eligibility Requirements

Hey, if you are looking to have an online credit card then, you need to meet all the mandatory requirements to eligible for it-

- Good Credit History

Do you know there are many banks, which do not follow other details except your credit history? Therefore, you should maintain a good credit score as well.

- Residential Status

There are many banks, which only consider the local or native residential people to provide a credit card. Many banks also allow temporary residents to provide credit cards.

- Income

In terms of getting approval, you need to meet a certain income. If you cannot show these income requirements then you must go for low-income credit cards.

Step 3. Necessary documents & information collection

We should remember one thing that we need to attach a couple of documents and personal information to get instant approval-

- Identity Proof

You can provide a birth certificate, Medicare card, and driving license to any of them.

- Personal Details

Here, you need to include your full name, contact details, and residential address.

- Employment and Income

You should mention your employment proof by providing your latest payslip and employee details.

- Balance transfer Details

Here, you need to provide your existing bank details and transferring the amount.

Step 4. Apply online

We are looking to make sure from you that the above-mentioned details are mentioned thoroughly by you to apply for an online credit card.

Best Instant Approval Credit Cards:

Here, we have picked out some credit cards, which you can get instantly with quick approval-

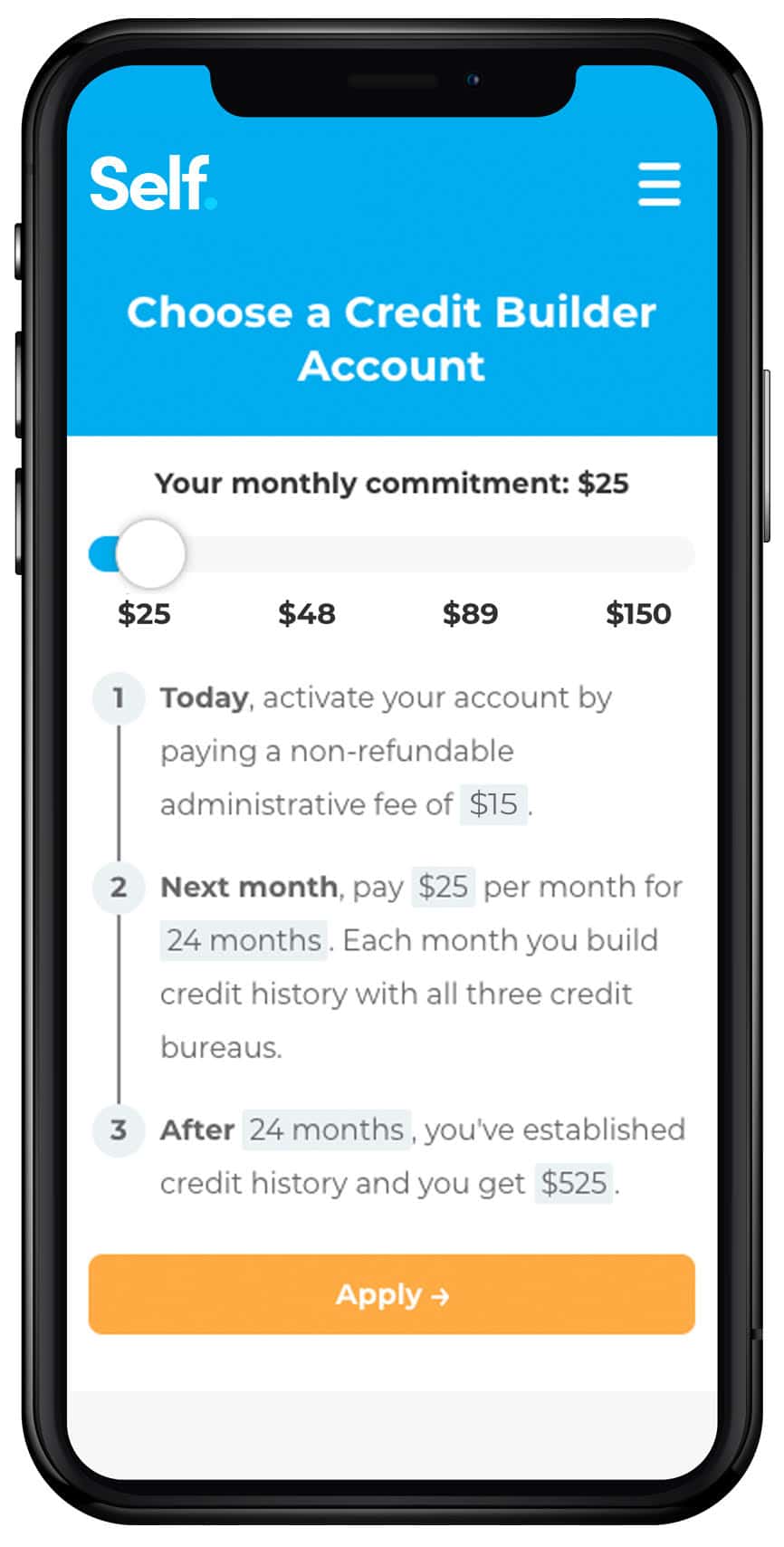

1. Self-Credit Builder Account

- You need to pay a minimum amount of $25/month for 12 months to get this card. If you pay for 2 years like this way then you will have $525 back after that time.

- If you have a low credit score then you can go for this card because it increases your credit and it is wonderful to get according to the low budget issue.

- The regular APR rate varies from 12.03%-15.98%.

- According to the product variant, the annual fees depend on $9- $15.

- One thing that is disappointing, that you cannot get any miles, reward points, and cashback from it.

2. Fingerhut Credit account issued by WebBank

The annual fees will really amaze you as it is $0 and it is a shopping cart. However, you cannot have any cashback, rewards, and miles. We mentioned before this is a shopping cart where you can get more than 500,000 items from reputed brands. This is not the end! You can get this card easily by applying online but it is not an accessible card.

3. OpenSky Secured Visa Credit Card

- The annual fee of this card is a little expensive $35 and the regular APR rate is 19.14%.

- Application is easy, there is no need for the credit check and you can build quick credit because it reports 3 major credit bureaus.

- You will get more fascinated if you know that 99% of the previous customers are able to build a strong credit score within 6 months.

- This is not the end! This credit card provider serves a community on Facebook where you can get the shared feedback of previous customers.

4. Horizon Gold Card

You will get the monthly auto-debited facility by paying $24.95 annually. You also can build a good credit score with this card because it also reports major credit bureaus. Moreover, you can get an unsecured credit limit and online approval is much faster than other cards. Not only that! You can feel free from the credit check and employment check eligibility. The initial credit line is $500 for this card.

5. Green Dot Primor Visa Gold Secured Credit Card

- This card offers you a 9.99% regular APR without any penalty rate, but the annual fee is high $49.

- You can get the credit lines within $200-$5,000. Moreover, you do not need to maintain any minimum credit score.

- You can have your card very fast because the application is quick and more than that, you can build a strong credit balance because they also report three national bureaus.

Yes, you can get approved for a credit card immediately. However, the credit limit you are given may be low for instant approval. To increase your chances of being approved for a higher credit limit, make sure you have a good credit score and that you are able to prove that you can handle credit responsibly.

Chime is not a credit card, but it is a banking app that offers some features that are similar to those of credit cards. Chime customers can use their phones to make purchases and access money they have saved in their accounts.

You May Also Like:

Hi This is Bavuma founder and writer for shutitdowndc. I am from a middle class family with 6 members. My parents being both bankers, elder sister being a CA have multiple choices as and when I think about shopping options. I am sure you will all agree that in the present scenario credit cards are preferred over carrying currency with us.