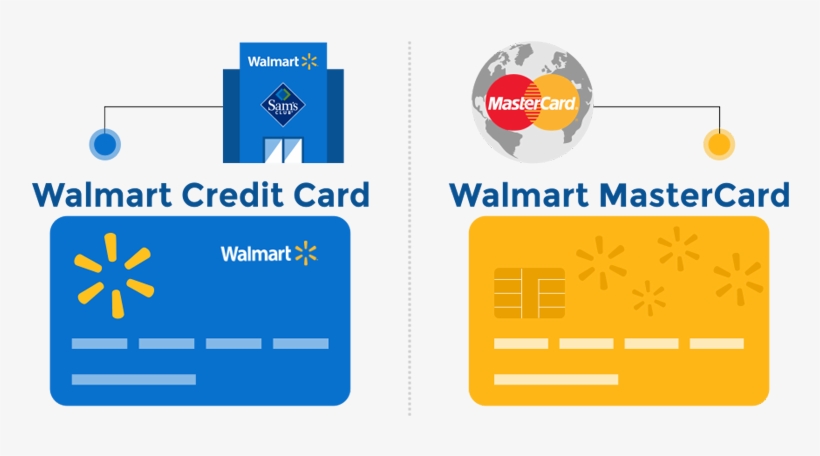

Have you tried Walmart’s credit card in your shopping? We all know millions of people in America shop from Walmart to save money. They provide almost everything at the cheapest prices as they register themselves largest retailers in the country. This is all seems wonderful, but what happens in terms of credit cards? Do you ever think about it? You can have two types of Walmart cards- one is Walmart MasterCard, which you can use anywhere. Another one is only Walmart Credit Card is valid only for Walmart stores, their online site, and in the gas station of Murphy USA. More or less, these two cards have their own significance and they have different approval criteria.

Brief Information About Walmart Credit Card With Bad Credit:

Yes, you are correctly thinking there is a difference between the accesses of these two cards, but they offer similar features and benefits. You can get cashback and rewards without giving any annual fees. Although you can get different reward points, you can have the highest bonuses and rewards from the online platform of walmart.com.

Related Read:

However, you may fill interest rates and late fines depend to be upon the high side in comparison with the same type of cards. Are you a regular shopper at Walmart? Therefore, you must have carried any card among these two. This is not the end you will get interested in these cards because they will give you 3% cashback as a decent incentive. If you are an employee of Walmart you can directly apply for a credit card using the Walmartone Employee portal.

Walmart Credit Card: Bad Credit OK!

Hey, have you used store credit cards? If you do, then you will definitely know that this typically restricted within the shops and stores. Unfortunately, you also can see this Walmart Credit card is different from these store cards. This card is although unable to meet all the requirements, but if you are unable to pursue the Walmart MasterCard then it will be better for you. Not only that! We have provided some key features of this card so that you can understand what barriers you may face if you pursue this card-

- You will get really disappointed because this card is only convenient for Walmart shops and online platforms.

- However, don’t be upset too much, because you can have a 3% cashback from their online platform, a 2% discount is valid from Murphy and Walmart gas station. Not only that! You can also get 1% cashback from their departmental store.

- Now you will think about how can you get your rewards? For this purpose, we can assure you that you will have your rewards on next month’s statement as a credit form.

- Though this card has multiple restrictions it provides you amazing offers like in the opening of your credit card account you can have $25 credit as a statement if you purchase anything worth $75 on that opening day.

- More than everything! You can buy an APR of 25.15% from this card.

However, who knows this credit will be the best among the USA countrymen if the 1% cashback offer is applicable for all departmental stores. Fore mostly, this card is considered as bad credit because the initial limit is very low.

Better Cards for Bad Credit: Walmart Credit Card

Are you looking for a diverse credit card? Then we can have plenty of choices for you as bad credit-

Total Visa Card:

This card is a wonderful example of which serves you an easy application and you can get any approval very fast. There are many people who think this card is the cheapest and most flexible card, but they are completely wrong. These cards are not at all cheapest because the customers need to give annual fees of $75 in the first year and after that, they have to pay $48 as an annual fee. However, you can easily access this card at any shopping site and shops of Walmart where accepts Visa.

Capital One Secured MasterCard:

As per the report, this is one of the most familiar and largest credit card companies which someone able to choose as bad credit. You also can go for it because it does not require any annual fee and you can have the highest credit limit at the very beginning. You can get sufficient credit after 5 months of consecutive payment.

Fingerhut Credit Account:

This is also a popular example of a card that works like a bad credit for buying different items from online platforms. This will be a good option for you to build up your credit according to the payment reported to all credit bureaus. However, you cannot use this card in Walmart stores and shops but it will definitely help you to increase your credit score as a conventional credit card. This is not the end! You need to pay much more to buy APR; therefore we can suggest you don’t carry too much balance with this card.

You May Also Like:

Hi This is Bavuma founder and writer for shutitdowndc. I am from a middle class family with 6 members. My parents being both bankers, elder sister being a CA have multiple choices as and when I think about shopping options. I am sure you will all agree that in the present scenario credit cards are preferred over carrying currency with us.