Are you planning to have to buy a new house? As we know the house will be your expensive purchase. Then let us find out together, what is your ideal price to buy your dream house. We will first proceed to the prime steps of the home-buying procedure.

However, we have good news for you that now you can buy your home on an affordable budget, which is much straightforward, and it does not take too much time.

It becomes more interesting when you buy a home with affordable bank rates by using the affordability calculator. Therefore, we need to know some basic information like monthly debts, savings balance, and monthly income.

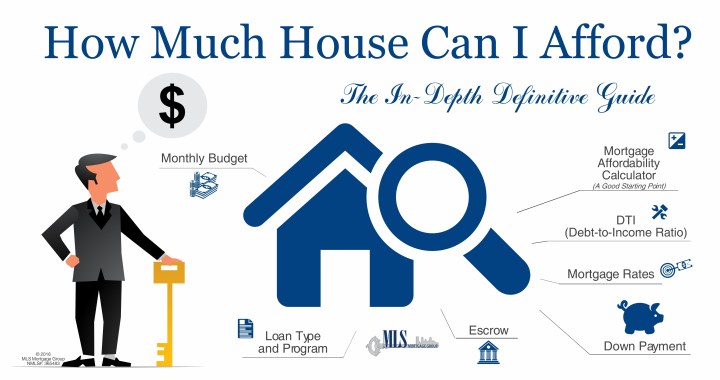

Numbering Strategy to Calculate:

This is an important part of the home buying process whether you need to follow some certain steps to crunching the numbers-

- At first, fix your budget by resolving the issue of your monthly income (including your partner and co-buyer). Moreover, you need to accumulate all necessary revenue streams from investment benefit and maintenance to rental income.

- Thereafter, you should list down the entire down payment and housing costs. In this list, make sure you have included house owner’s insurance costs, loan terms, annual property tax, and estimated mortgage interest rate. However, in this context, we may recommend you to go for 30 years.

- After all this, you need to sum up the whole amount, which will fix your house affordability.

Importance to Follow the 28/36% Rule:

In terms of buying your favorite house by increasing the income rate, that is a one-way ticket to economic difficulty. Not only that! You should stay alert in terms of unexpected expenses and emergency usage.

Therefore, you need to be preparing for it because you should not retain any space in your total budget. One more thing, you should remember that you do not mention your retirement savings.

We can advise you one thing for sure is that you should always remember not to spend more than 28% of your gross monthly income.

Not only that! You should also keep in mind that you could not exceed your expenditure more than 36% on total debt (including student loans or car loans and credit card payments) in housing.

Hence, this 28/36 percent rule is the most agreeable rule by the financial advisers in terms of the home affordability rule. This strategy makes a foundation on how much price you can pay for a house every month.

Best Interest rate of Affordable House:

Hey, do not know how to save your house building expenses? Then let us share with you snagging a low interest rate can protect your ten thousand dollars over the entire life of your loan.

Therefore, it is better to go for the lowest rate. Here, we have mentioned some basic steps which will make their application a low-rate worthy and attractive one.

However, the latest trend of lenders is the lowest debt, highest credit scores, and substantial down payments.

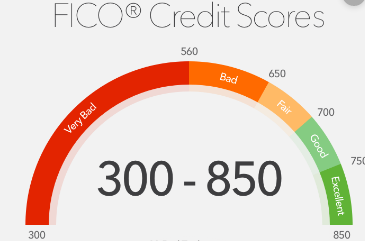

1. Credit Score

Before you apply for a mortgage, this is the ideal time to earn your credit. At first, you need to check your credit report from one of the huge three agencies like Experian, Equifax, and TransUnion.

Moreover, you can earn a free copy for each agency/year. Not only that! You need to review carefully about your report and point out the incorrect information along with negative marks.

More than anything, if you get any mistakes about your report then you need to alert your credit-reporting agency as soon as possible.

However, you need to be aware that it needs to make prove, as the claims are all incorrectly provided payment history. Not only that! If you notice any fraudulent report then you need to inform your local police and register a fraud report.

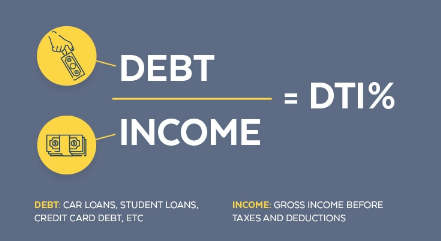

2. Debt-to-income ratio

This is just a comparison of your monthly income to your monthly debt. However, this is really a crucial number because it considers borrowers your frequency to guess more debt.

As you have a higher DTI, it will get a harder mortgage and it is sufficient less a good interest rate. However, several lenders will not allow a borrower with a DTI of more than 43%.

This is not the end! It is a great idea for the borrowers to award much remaining debt as possible to enable a mortgage as well as to create space for a mortgage payment.

However, through this technique, you will be able to increase your resources of emergency expenses and can adjust your monthly expenses.

3. Down Payment

We should remember that lenders have to compromise less money and it creates a better mortgage and bigger down payments. Here, the loan-to-value (LTV) ratio considers reporting your down payment.

Therefore, if you provide a bigger down payment it will take lessen the LTV to minimize the risk of the lender.

However, it is not easy to manage a large down payment therefore it takes time and the down payment is a little lesser.

We can see many homebuyers who usually go to Government whether you also can find down-payment assistance for buyers with low down payments. Moreover, you need to ensure this from your lender and local Government whether you are eligible or not.

You May Also Like:

Frequently Asked Questions:

There is process called pre-qualification taken by lenders to check account to determine how much they are willing to lend you.

1. Your debt-to-income ratio, as we discussed earlier.

2. Previous history of paying bills on time.

3. Proof of fixed income.

4. The amount of down payment you’ve saved.

While considering how much house you can afford. The 28%/36% rule is a broadly accepted starting point for determining home affordability, but you’ll still want to take your entire financial situation into account.

Hi This is Bavuma founder and writer for shutitdowndc. I am from a middle class family with 6 members. My parents being both bankers, elder sister being a CA have multiple choices as and when I think about shopping options. I am sure you will all agree that in the present scenario credit cards are preferred over carrying currency with us.